You Better Shop Around

Rule number one, obviously, my favorite. Obviously, the most important. That’s why it’s rule number one to take control of your finances, is to always shop around. And again, shopping around for your college education. See, we didn’t have to think this way, Rob.

Didn’t have to shop. Most people used to go to a state university, and it was a non-profit, and tuition was the same everywhere, and you made the decision purely based on what’s school had a better degree program, or maybe what football team you liked, right?

Right, wrong, or indifferent, there was no real financial decision to be made, because the state colleges were all pretty much the same. And obviously, the Ivy League colleges were more expensive, and people may weigh that. But then you have the new nonprofits show up, and they’re more expensive than the Ivy League.

So shopping around, I think most people would recognize that the online degree from a bad actor like a Corinthian is no better and probably worse than a local community college degree. And the community college is, like, 1/10 of the price. I mean, it’s much, much, more affordable. Shopping around could have helped there.

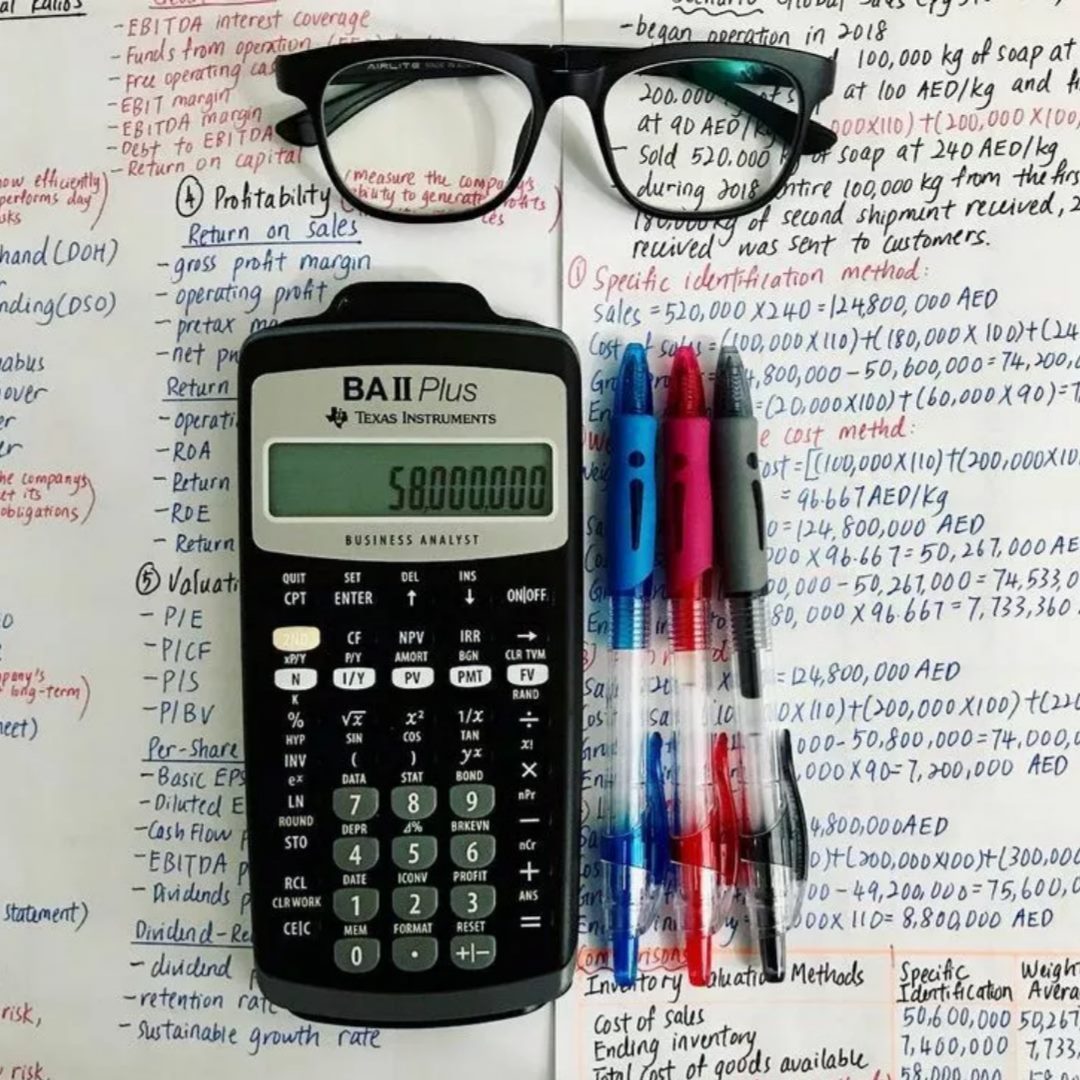

Knowing Your Numbers

Rule number two, know your numbers, know your credit score, know your home’s value, know your balances, know your interest rates. Don’t become a victim of identity theft. Monitor your credit report. Know your credit card purchases and balance.

Look at the PDF of the statement. Understand how much money you are truly paying in interest every month. Understand what your balances are.

If you monitor your balances from month-to-month, then you can understand whether or not they’re actually going down, right? If the whole idea is to pay off your debt, you have to understand what the balance was last month to know that the balance this month is lower or higher, and are you moving in the right direction? That’s rule number two.

The Three Day Rule

Rule number three, the three-day rule. Three-day waiting period on large purchases or new debts. Again, someone who was contacted by a for-profit college.

I use this a lot in the early days of starting my company, whether it was copy machine salesman, or phone system salesman, or whatever it was, I would always wait three days. I would always is self-impose a three-day cooling-off period, a three-day waiting period before signing any debt or making any decision on a large purchase.

Don’t Abuse Credit, But Don’t Fear it Either

Rule number four. Don’t abuse credit, but don’t fear it either. I still have people out there who are afraid of having credit cards, who think that having credit cards is an automatic path to financial ruin. It is not. Just like guns don’t kill people, people kill people, credit cards are not the road to financial ruin.

Misuse of credit cards is the road to financial ruin. And there are a lot of people like myself who are able to use credit cards very effectively– and this is the financial ninja way– very effectively to rack up points, to rack up vacations, to rack up discounts, to rack up down payment on a new vehicle. There’s all these wonderful things you can use the credit cards to take advantage of the banks, to take advantage of the credit card issuers, and shift the power back to us as consumers. This is how we do it as financial ninjas.

We are not going to abuse the credit. We are not going to let the credit ruin us financially. We are not going to live beyond our means. We are not going to buy things we cannot afford. But we are going to take control of your finances and full advantage of the benefits that credit cards offer when it comes to fraud protections, when it comes to racking up points, and getting perks and benefits.

We’re just not going to pay any interest. Because we’re going to pay those cards off on time, every time, before the end of the grace period, right? That’s rule number four.

They Have Tricks, But You Don’t Have to Fall for Them

Rule number five. If you know their tricks, they won’t work. Again, just the simple explanations I’ve given this morning on for-profit colleges may save the next person from falling victim to that, right? If you know the tricks, if you understand that part of their trick is to keep you on the phone until you commit, that that free laptop or iPad they’re going to give you is going to cost you $100,000 in the long run by the time you pay interest and repay the mortgage loans, if you know the trick that they want to hide your credit card statement from you by having you go to online banking so you don’t see the interest calculations, and you don’t see the interest rates, if you know all these tricks, they don’t work anymore.

When I was a kid, I remember seeing my first card trick, and I was amazed. This friend of mine did a card trick where he guessed my card, and as soon as he explained to me how he did it, it seemed like the stupidest thing ever. But until I knew the trick, right? As soon as I know the trick, it was so obvious and I felt like an idiot. But right up until I knew the trick, it was working.

It seemed like magic. And as soon as I knew the trick, it didn’t work anymore. And so, one of the main purposes of this show is to expose these tricks so that you know them. Because rule number five is, if you know their tricks, they won’t work.

Shout it From the Mountains

Rule number six, spread your knowledge, educate friends and family. If you know someone, again, there are people out there right now who are entitled to these refunds on this Corinthian deal. There are people out there who may be about to be taken advantage of by a for-profit college. You’ve got to spread your knowledge, right? So I am now sharing this with 200,000 or 250,000 listeners out there across my 42-station network.

But I need you to now tell two or three people. I need you to tell your friends and family. I need you to spread your knowledge. I need you to educate your friends and family. It’s the only way, as a society, we can fight back.

We can stop being financial zombies and. We can stop meandering around, bouncing off of chain link fences, not making decisions when it comes to our financial future, when it comes to financial literacy, when it comes to understanding credit cards, credit scores, interest, all the things that are so important in our lives. So I need all of you out there in my Saving Thousands army to spread this knowledge, to educate your friends and family, and to bring them up to speed, because that’s how we all become more empowered as consumers to take control of your finances, and that’s how we fight back against the big financial services companies, and the crooked for-profit colleges, and everybody out there who’s trying to get rich by taking advantage of us as a whole. And we’re not going to stand for it, and we’ve got to spread our knowledge. Rule number six.

Take Control of Your Finances : The Investment of a Lifetime

Rule number seven, own real estate sooner, not later. This is, to me, the biggest downside and the biggest pitfall, people who fell victim to the student loan trap and the student loan frauds. It will impact their ability to own real estate. It will impact their ability to be a homeowner. It will prevent them from being able to own a home, and start accumulating equity, and accumulating wealth, right, and building up to something, and building massive amounts of wealth.

And unfortunately, I don’t have a solution for it. We’re going to try to put one together. We’re going to try to figure out some type of relief. But one of the big problems this is going to cause is that student loan debt, that high amount of student loan debt that we’ve seen build out there is going to prevent people from owning real estate.

Yesterday, we talked about the $1.2 billion equity fund that JP Morgan put together to invest in rental properties, right? Through a big rental property conglomerate. They understand the wealth being created by owning property, and they want to take advantage of fact that a lot of us can’t buy houses, a lot of us can’t be property owners, a lot of us can’t be homeowners, because we’re saddled with student loan debt, or because we haven’t taken care of our credit scores and our bills in the past, or we’re just afraid, right? And the fear is the worst thing, Rob, because it’s so easy to be corrected. There’s no need to be afraid.

Pick up the phone, call us, call someone. See if you can get approved for a home loan and go out and buy a house. Rule number seven, own real estate sooner, not later.

We Are Talking About Practice

Rule number eight, practice what you learn and always learn more. This is one of my favorites, Rob. If you’re not going to pay attention or if you’re not going to put to use the things I’m telling you, you might as well be listening to Britney Spears on the pop station a few turns of the dial over. If you’re going to spend your days here with me, if you’re going to spend an hour a day listening to me talk, and empower you with these rules, and empower you with this knowledge, you’ve got to put it to use, you’ve got to practice what you learn, and you’ve got to always be willing to learn more.

Even I, myself, don’t think I know it all. I can always learn from others. I can always learn something. I learn something new every day, and that’s my goal, is to learn something new every day, and to put into practice these rules, to put into practice the things I learn, so that I can be a more empowered consumer, and I can help empower other consumers.

Spread the Word

Number nine, share your successes. So this is different. We talked about sharing your knowledge, but it’s also very important that you share your successes, right? So when you’re able to save money, when you’re able to avoid a scam, when you’re able to make a good decision. Say you’re called by one of these for-profit colleges.

And because you shop around and use the three-day rule, you end up going to a community college, because it’s 1/10 the cost for the same quality, if not, a better quality of education. You’ve got to share that success with your friends, right? They will listen to you on the knowledge piece a little.

They will listen to you on the success piece a lot. So if you find yourself saving money, if you find yourself fighting back, if you find a trick and you avoid it, that is a success. And rule number nine is, you’ve got to share your successes.

Let’s Get To Saving and Take Control of Your Finances

Rule number 10. I want you have a savings account equal to your last three months of gross pay, right? Last three months of gross pay.

This number is constantly changing. As you’re getting raises, it’s going up. As you’re working more overtime, it’s going up. This is the only way to truly prepare yourself for the possible bumps and hiccups down the road.

To be a financial ninja, we’re never going to find ourselves in a situation where we are desperate for money and have to rely on debt. And if we have a savings account with our last three months of gross pay right there, sitting there waiting for us, we can avoid those situations. We can be empowered.

Hold on to the Essentials

Rule number 11. We’re not going to gamble with the essentials, OK? What are the essentials? The essentials are our retirement accounts. The essentials are that savings account we just talked about.

We’re not going to bet it all on some hot stock tip that we got from our buddy. We’re not going to sink it into Apple stock because we think it’s going to go up when it’s had a rough and rocky ride, and people have definitely lost money there. We’re also not going to gamble with our home, if we are buying a home. If we’re following rule number seven and we’re going to own real estate, we are not going to gamble with our rate lock. Rob, we’ve seen rates go up considerably in the last couple weeks.

All the people who didn’t lock their rate in, who let the mortgage broker or mortgage guy talk them out of the rate lock. Oh, float the rate. I got a feeling things are going to get better. All those people are now staring down significantly higher payments, and in some cases, it can actually cost you your ability to buy the home at all. If interest rates move up too high and you didn’t lock your rate in, you may no longer qualify to buy that home.

And I don’t want anyone to find themselves in a situation where they’ve committed to buying a house, they’ve gotten a contact on a house, they’ve told their friends and family, and shown the kids, and shown the wife, or shown the husband, made plans to change schools, and change banks, and everything else, and then a week before closing, you find out that you didn’t lock your rate in. The rate is now considerably higher. And now you find that you don’t qualify.

So we do not gamble with the essentials. This is retirement accounts, savings accounts, interest rate locks. Don’t gamble with the essentials. There are certain things in life we just absolutely have to play it safe with. That’s rule number 11.

Under Investigation

Rule number 12 is, we’re going to check references. We’re going to use Google or whatever your preferred search engine is, and we’re going to put in the name of a company that we’re considering doing business with, followed by the word, scam. We’re going to put in the name of that company, followed by the word, reviews. We’re going to put in that company, followed by the letters BBB or Better Business Bureau so we can check out their Better Business Bureau rating and see if they’re an accredited business.

We’re also going to put in the name of that company, followed by the word, complaints. We’re going to look at this information and we’re going to process this information, and we’re going to make better decisions as consumers. Rule number 12.

Show Them What You’re Made Of

Rule number 13, if you own or run a business, I want you to be transparent with your consumers. I did it in my business. I’ve been wildly-successful because of it. When you puts consumers first, you can succeed, you can win.

Don’t listen to all the hype. Don’t let the greed, don’t let examples like Corinthian, just because they brought in $3.5 billion by taking advantage of people with student loans, don’t let that let you sway from the cause. You can build a better business and a long-term sustainable business if you put your customer first, and you are transparent with your customer. And this is going to be the subject of my upcoming book, Rob, which I’m going to release later this year.